The global flow of softwood logs from countries with a surplus of wood raw-material to regions with tight, or costly log supply and higher consumption of forest products continued to expand for the third consecutive year. In 2018, WRI estimates show that the total trade of softwood logs in 2018 reached a new record high of 93 million m3. This was up from just 61 million m3 immediately following the Global Financial Crisis (GFC) in 2007/08, a remarkable 52 per cent increase in trade in just ten years. Over the past decade, imports by Asia, Eastern Europe, and the Nordic countries have increased the most, while imports to Central Europe have grown more modestly.

Log imports to China (the world’s largest log importer) actually fell eight percent in the 1Q/19 from the previous quarter, the biggest quarter-over-quarter decline in four years, reports the WRQ. This was the third consecutive quarter with reduced import volumes of logs and lumber, reflecting slowing economic activities in China in the second half of 2018 and early 2019.

Sawlog prices fell throughout the world in the 1Q/19 due to plentiful supply or reduced demand for lumber, depending on the region. The Global Sawlog Price Index (GSPI) fell 1.8 per cent quarter-over-quarter in the 1Q/19 to its lowest level since the 2Q/17. Despite having declined almost eight per cent in one year, the current GSPI is still only a few percentage points below its 10-year average. The biggest declines over the past year have been in Austria, Germany, the U.S. Northwest, the Czech Republic and Northwest Russia.

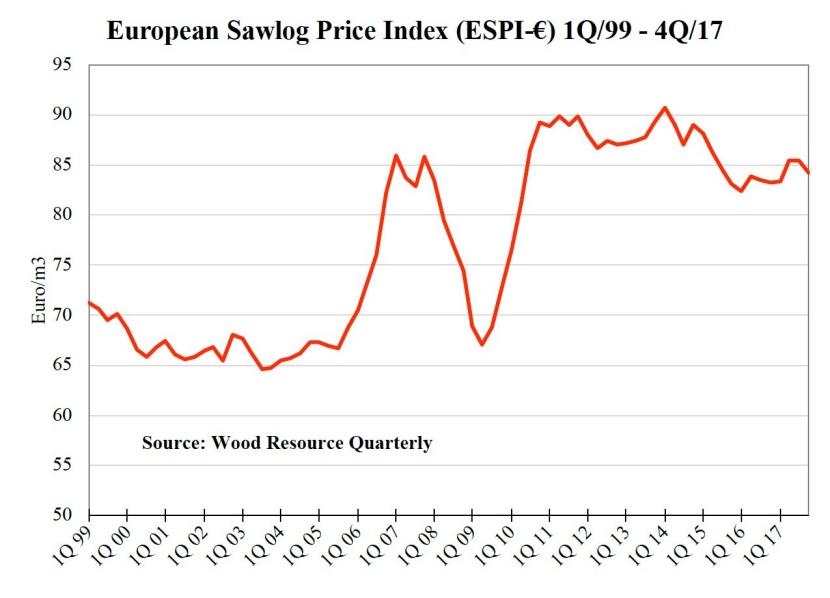

In the 1Q/19, the Euro-denominated European Sawlog Price Index (ESPI) dropped 3.1 per cent from the previous quarter to its lowest level since 2010. The downward price pressure on sawlogs was mostly a reflection of sufficient log supply, and only slightly connected to lower demand for raw-material by the sawmilling sectors throughout Europe. The largest price reductions from the 4Q/18 to the 1Q/19 occurred in the Czech Republic, Germany, Finland, Austria and Latvia.