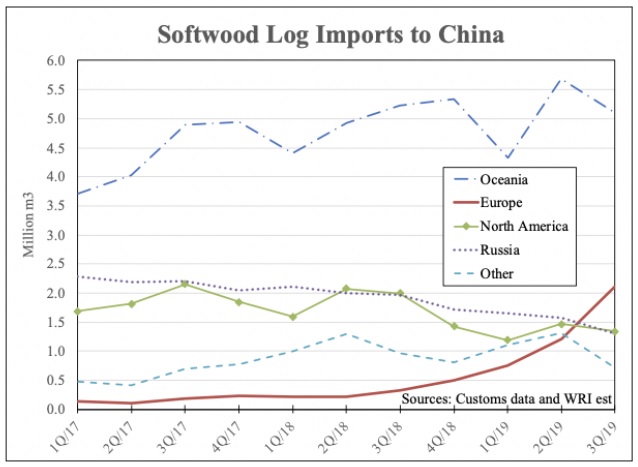

New Zealand continues to expand its market share in China, supplying 39% of the total import volume in the 3Q 2019, up from 32% five years earlier. Russia and North America suffered the largest declines in the Chinese market share from 2015 to 2019, with Russia’s share falling from 28% to 12%, and North America from 21% to 13% during the same period, as the Wood Resource Quarterly reported.

In the 3Q 2019, log imports from Russia were at their lowest levels in almost 20 years. The only other major change in the Chinese market over the past few years has been an increase in pine log shipments from Uruguay.

These have increased from just a few thousand cubic meters in 2016 to almost 2.5 million m3 last year, making Uruguay the fifth largest log supplier to China in 2018. Startlingly, shipments from Uruguay to China fell to less than 200,000 m3 in the 3Q 2019, when prices for logs plummeted to the point where it no longer made financial sense for Uruguayan exporters to ship logs.

Interestingly, a number of countries in Europe, although some still small suppliers, have begun to expand their presence in the Chinese market over the past 12 months, reports the WRQ. This can be attributed to an oversupply of logs in their domestic markets. In the 3Q 2019, the European supply of softwood logs totaled over two million m3.

Supplying countries included Germany, Czech, Poland and France (in descending order), all countries impacted by storms and insects in 2018 and 2019. The European share of imported softwood logs has increased from just 3% in the 3Q 2018 to as much as 20% in the 3Q 2019.